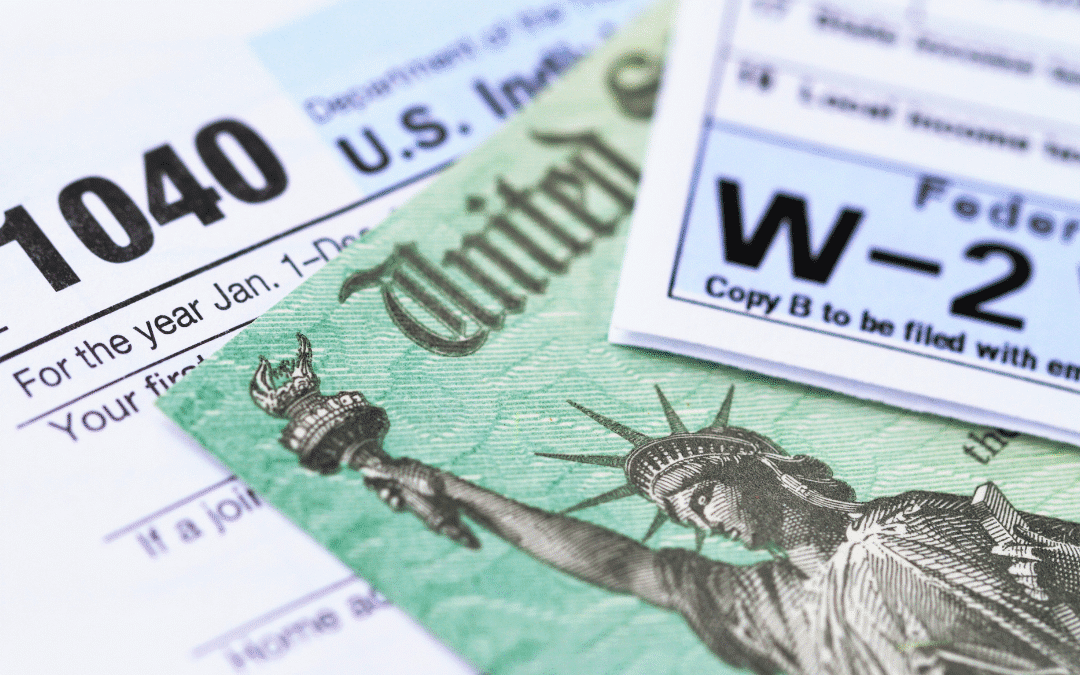

Explanation of the Build Up Mississippi Act (House Bill 1)

The Build Up Mississippi Act (House Bill 1), signed into law by Governor Tate Reeves on March 27, 2025, is a transformative piece of legislation aimed at phasing out Mississippi’s state personal income tax, reducing the state grocery sales tax, increasing the gasoline tax, and granting local governments the authority to adjust grocery taxes under specific conditions.